🛄Claimable Balances

What are Claimable balances?

🤝 Understanding trustlines on Stellar

In a standard payment on the Stellar Network, you will need to ensure the recipient of your transaction has a trustline enabled for the asset you’re sending. Just one asset on the network doesn’t follow this, which is the native token XLM, as it’s the only trustless asset on the network.

When a standard payment is made, but no trustline is enabled, the sender will receive an error as the network won’t allow them to send the payment. This can be frustrating, as you would need to find out every potential receiver of an asset and ask each one to enable the assets trustline, all before a payment can be made. As frustrating as this is for the sender, this means Stellar users aren’t being forced to accept assets they don’t want.

Trustlines are an important security feature, as it means your wallet won’t get flooded with random assets that you don’t trust, unlike other blockchains where you can be sent tokens you didn’t ask to have. The best example would be the Shiba Inu token, where the founder sent Vitalik Buterin, a co-founder of Ethereum, 50% of the SHIB (ERC-20) token supply, without his consent.

Claimable balances on Stellar can help avoid these issues and places the security of your wallet in your hands.

🛄 So what are Claimable Balances

Claimable balances are a way for entities to operate a payment in two parts, a sending portion and a receiving portion. This means somebody can send you a payment of an asset you don’t hold a trustline for, and you can decide if you would like to accept it or not.

This newer feature of the Stellar Network creates opportunities that weren’t possible before on the network.

Claimable balances can be designed with time restraints, like claiming before, during, or after a certain time. This gives developers opportunities to create time restricted airdrops, like our initial airdrop of AQUA tokens. In our Initial Airdrop we have restrictions of 30 days for each of the 5 phases. For our AQUA token, when a Claimable Balance isn’t claimed it is returned to the community DAO fund.

It always comes down to the distributers discretion to what happens to their tokens. Some distributers may burn tokens when not claimed, or they may leave them always available for redemption, so always check the payment for time restraints.

This design also means that, for example, anchors on the network are able to send payments (possibly a remittance) on the network to be claimed in a certain time frame. The anchor could set a 24 hour time frame and if it isn’t claimed by the receiver in time, then it’ll be collected by the anchor and given back to the original customer.

🏋️ Example

Aquarius sends 100 AQUA to 10 recipients of the initial airdrop, all with a 30 day time limit to be claimed.

5 wallets claim their tokens in the 30 day time restraint.

Once the 30 days elapse, the protocol recovers those tokens not collected by users.

This means 500 AQUA tokens aren’t lost on the network and can be moved into the community DAO fund.

This type of operation means those unclaimed tokens can be reused instead of staying unclaimed, whilst also giving everyone a fair chance to receive tokens they’re entitled to. Even those without trustlines already enabled! Additionally this allows users who aren’t interested to not participate if they wish.

💪 Claimable Balances In Action

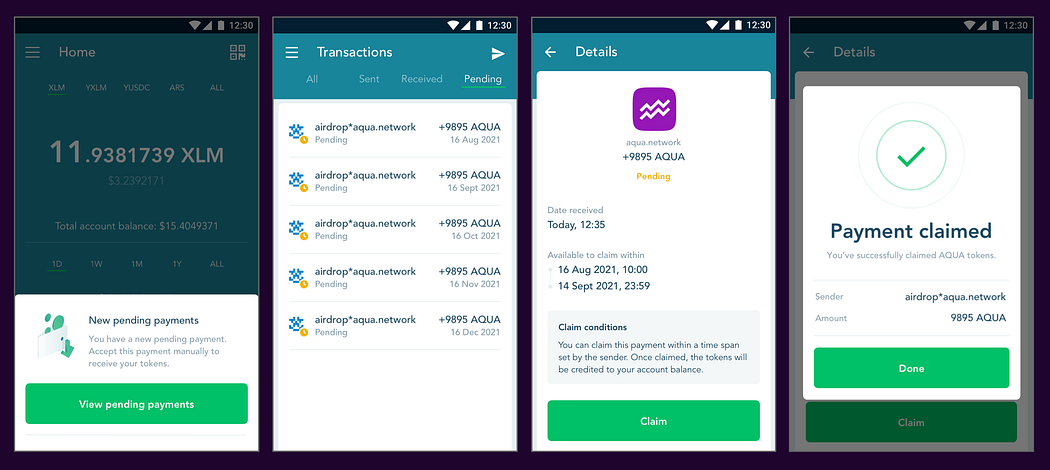

Here are some screenshots of our test build showing how Claimable Balances should look in the near future on the LOBSTR wallet app. The flow from left to right shows the in app notification, the pending transaction screen, the details of a claimable balance, and what a claimed payment will look like.

Last updated