❔How to vote for markets on Aquarius

The main goal of Aquarius is to incentivize liquidity provision on the Stellar network through the distribution of AQUA tokens via SDEX & AMM rewards. The markets for incentivization are chosen based on voting.

Using our voting mechanism, AQUA holders can allocate their tokens towards voting wallets for Stellar markets - directly or freezing them first into ICE, thus boosting voting power. Anyone can set up voting wallets for nearly any asset on Stellar.

Liquidity voting is done entirely on the Stellar blockchain through on-chain operations using a similar method as governance voting. This method of voting makes all results verifiable by anyone. Votes are locked into the Stellar blockchain through claimable balances enabling transparency and immutability, with vote tampering being made obsolete.

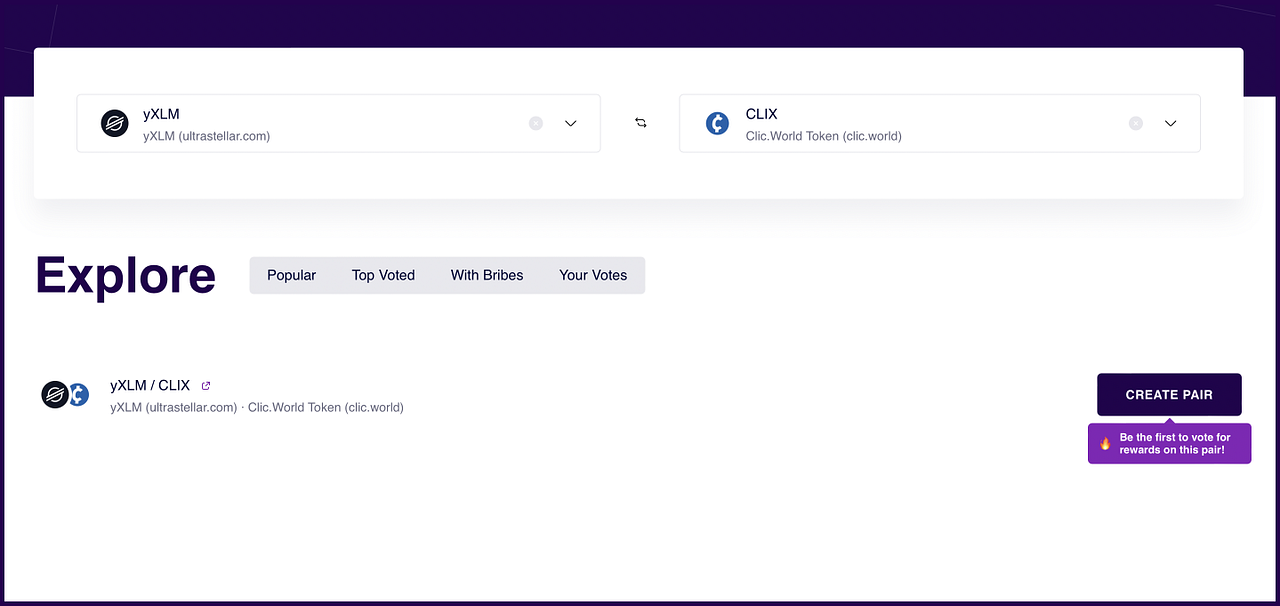

🔎 Search For Pairs

Once inside the voting platform, you can start exploring Stellar market pairs. You can use the tabs to view the most popular pairs, top voted pairs, or pairs with bribes. To add a pair to your vote, click Add To Vote.

More adventurous users can use the search bar to find specific pairs. Using this option may return pairs that haven’t been voted for before. These will show a Create Pair tab next to them. Adding these to your vote will enable others to vote for this pair. Creating pairs requires up to 5 XLM, which gets used to make new voting wallets containing trustlines for the assets in question.

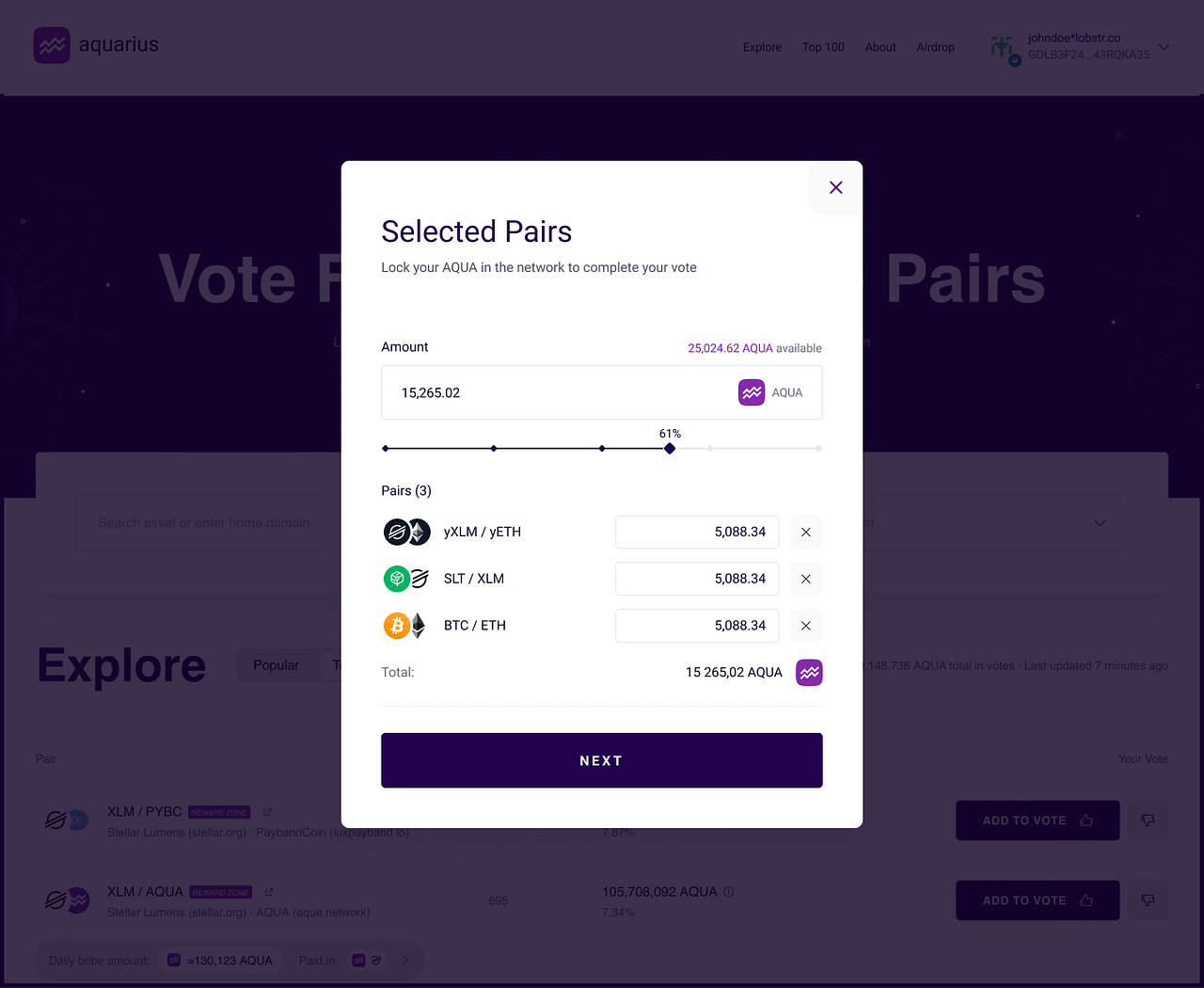

🗳 Selected Pairs

As you add and create pairs, they get placed in your "voting basket". You can navigate to it anytime by clicking the “chosen pairs” bubble in the bottom right corner.

Inside the modal window, you can adjust the amount of AQUA you dedicate towards voting, then break down how much you would like to allocate to each pair. After you have decided, click next to select the Vote Period.

The vote period allows you to lock in votes for various amounts of time, ranging from 1 week to 6 months. Note that your AQUA will stay locked in this market. If you want flexibility and be able to withdraw votes at any time, we suggest that you freeze AQUA into ICE and use the latter for voting.

If you vote with upvoteICE, you won't have to select the "Vote period". Instead, you will proceed to submiting the transasction right away.

👎 Downvotes

Next to add to vote, you will also see the 👎 symbol. Clicking this allows you to downvote a pair. If you see a market you disapprove of, you can use downvotes as a way to move it down the reward zone. Using this option will bring a market down in the rankings by taking votes off its total.

To keep track of markets upvotes & downvotes, hover the cursor over the total to see the breakdown.

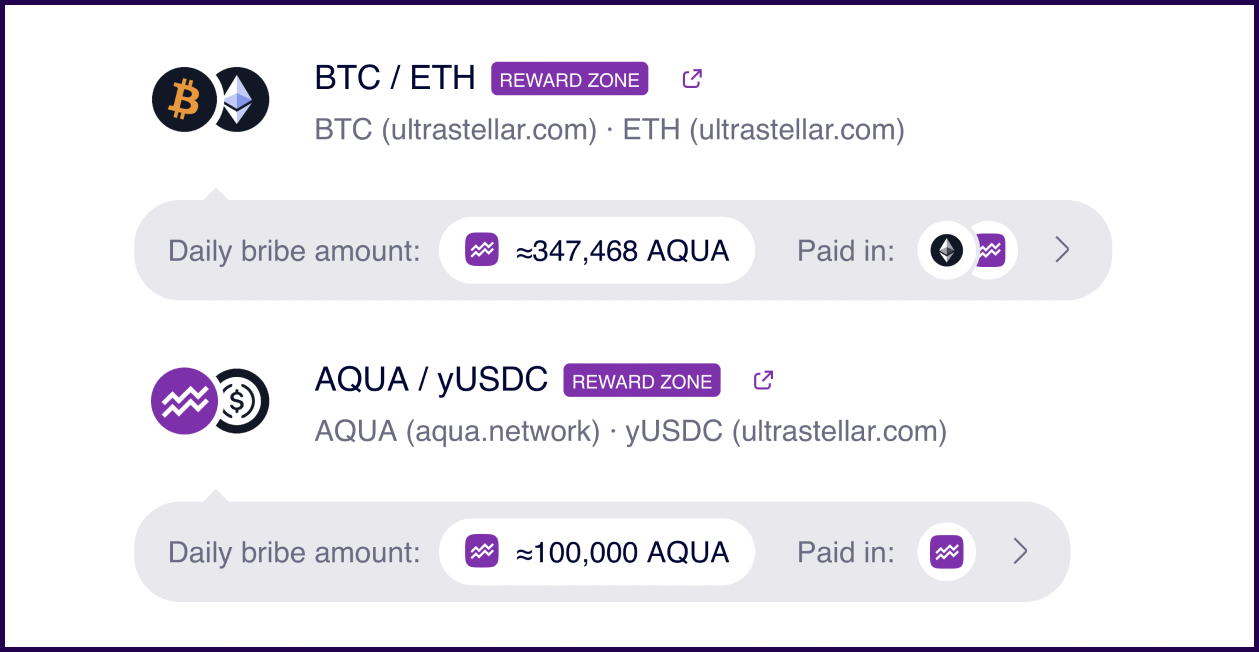

🎁 Bribes

You can find bribes under certain markets. Anyone, mainly project owners, can place bribes upon markets to incentivize AQUA holders to vote for specific pairs in exchange for daily payouts. You can find over upcoming bribes and bribe creation at vote.aqua.network/bribes.

Voters can check each bribe by clicking the bubble to see how long it’s active and which Stellar assets are offered as incentives. To receive a bribe, all a user needs to do is vote for a market with a bribe attached and ensure they have trustlines enabled for the assets offered as bribes. The bribes will arrive to the voting wallet automatically.

➕ Adding more votes

If you decide to add more votes to the market you already voted for, you can do so clicking on the 👍 button which will add this market to the "voting basket" once again.

➖ Withdrawing votes

To withdraw your vote (after the "Vote period" for AQUA tokens and anytime for upvoteICE tokens) you have to go to My Aquarius, select "My liquidity Votes" tab and find "Manage unlocked votes" button.

In the modal that shows up you should select the markets you want to withdraw your votes from and hit "Claim selected" to proceed to creating a transaction.

⏫ Boosts

As part of the DAI proposal #96 the markets paired with AQUA get 50% LP reward boost, and markets paired with USDC or XLM get 30% boost. These boosts are cumulative.

Note that liquidity providers, not voters, benefit from the boost. Check this page to learn how to provide liquidity to Aquarius.

Last updated